PA DoR REV-1220 AS 2008 free printable template

Show details

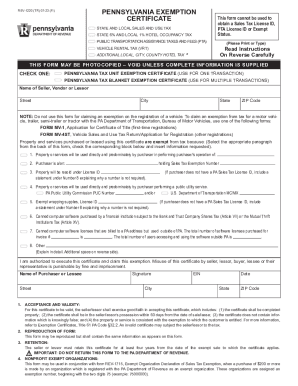

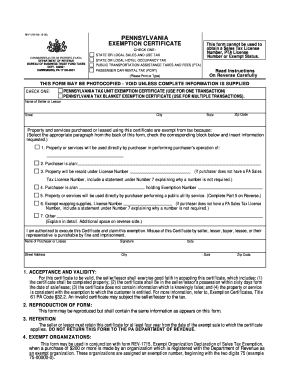

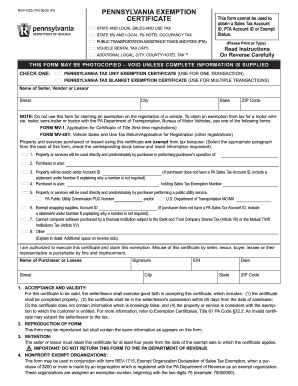

REV-1220 AS 9-08 I PENNSYLVANIA EXEMPTION CERTIFICATE CHECK ONE STATE OR LOCAL SALES AND USE TAX BUREAU OF BUSINESS TRUST FUND TAXES PO BOX 280901 HARRISBURG PA 17128-0901 This form cannot be used to obtain a Sales Tax License Number PTA License Number or Exempt Status. To claim an exemption from tax for a motor vehicle trailer semi-trailer or tractor with the PA Department of Transportation Bureau of Motor Vehicles use one of the following forms FORM MV-1 Application for Certificate of Title...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa rev 1220 2008

Edit your pa rev 1220 2008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa rev 1220 2008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa rev 1220 2008 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pa rev 1220 2008. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-1220 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pa rev 1220 2008

How to fill out PA DoR REV-1220 AS

01

Begin by obtaining the PA DoR REV-1220 AS form from the official Pennsylvania Department of Revenue website or your local office.

02

Carefully read the instructions provided with the form for specific guidelines related to your situation.

03

Fill out the personal information section, including your name, address, and Social Security number.

04

Provide the necessary financial details as requested on the form, ensuring accuracy in numbers.

05

Include any supporting documents or additional information required as per the form instructions.

06

Review your completed form for any errors or omissions.

07

Sign and date the form, certifying the information is correct.

08

Submit the form via mail or electronically, according to the submission guidelines provided.

Who needs PA DoR REV-1220 AS?

01

Individuals or entities in Pennsylvania who need to report specific tax information to the Pennsylvania Department of Revenue.

02

Taxpayers who have taxable income or transactions that require reporting for compliance purposes.

03

Those participating in tax programs or seeking refunds related to tax credits.

Fill

form

: Try Risk Free

What is form pa rev 1220?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

People Also Ask about

How long is a Texas exemption certificate good for?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

How do I get a PA sales tax exemption certificate?

You may register for a Sales Tax License online at .pa100.state.pa.us or you can order a Combines Enterprise Registration Application from our forms ordering service by dialing toll-free, 24 hours a day, 1-800-362-2050.

Who is exemption from hotel occupancy tax in Pennsylvania?

Hotel Occupancy Tax – Guidance for U.S. Government Employees Traveling on Government Business. If an employee of the United States government is staying in a Pennsylvania hotel on official government business, the room is generally exempt from Pennsylvania hotel occupancy taxes if the room is paid for by the government

Does PA Rev 1220 expire?

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies.

How do I fill out a Pennsylvania exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What is PA Rev 1220?

1. Revised 9/8/2022. Purpose: Use this guide to properly completing the PA Exemption Certificate (REV-1220). NOTE: This. form may be used in conjunction with your sales tax/wholesaler license to claim exemptions from sales tax for the purpose of resale.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pa rev 1220 form?

The PA Rev-1220 form is a tax form used in the state of Pennsylvania. It is known as the "Application for Extension of Time to File Pennsylvania Personal Income Tax Return." This form is used to request an extension for filing a Pennsylvania personal income tax return. By submitting this form, individuals can receive an extension of up to six months to file their tax return, allowing them more time to gather and organize their financial information.

Who is required to file pa rev 1220 form?

The PA REV-1220 form is required to be filed by individuals or entities that have business activities or operations in Pennsylvania and are subject to the Pennsylvania personal income tax or corporate tax. This may include residents, non-residents, or part-year residents who have state tax liabilities, as well as corporations, partnerships, or other business entities that have generated income or conducted business activities in Pennsylvania. However, it is important to consult the specific instructions and requirements of the form to determine if you are required to file it in your particular situation.

How to fill out pa rev 1220 form?

To fill out the PA REV 1220 form, you can follow these steps:

1. Begin by downloading the PA REV 1220 form from the official Pennsylvania Department of Revenue website.

2. Enter the tax year for which you are filing the form.

3. In Part I, provide your taxpayer identification number and legal name as it appears on your tax return.

4. Fill in your current mailing address, including street address, city, state, and ZIP code.

5. In Part II, indicate your filing status by checking the appropriate box (Single, Married Filing Jointly, etc.).

6. If you are married and filing jointly, provide your spouse's name and Social Security number in the designated fields.

7. Check the box in Part III to confirm whether you are a full-year Pennsylvania resident, part-year resident, or nonresident.

8. In Part IV, report any qualifying PA-allocated and PA-source income you earned during the tax year, such as wages, interest, dividends, etc.

9. If you have any income exempt from Pennsylvania personal income tax, report it in Part V.

10. In Part VI, calculate any credits you are eligible for and provide the necessary details according to the form's instructions.

11. If you are claiming any Schedule OC or Schedule G-L exemptions, complete Part VII as applicable.

12. Review all the information provided to ensure accuracy and make any necessary corrections.

13. Sign and date the form in the designated area.

14. Keep a copy of the completed form for your records.

Note: This is a general overview of how to fill out the PA REV 1220 form. The specific instructions and requirements may vary, so it is always recommended to carefully read and follow the instructions provided with the form. Additionally, consulting a tax professional or utilizing tax preparation software can help ensure accurate completion of the form.

What is the purpose of pa rev 1220 form?

The purpose of the PA REV-1220 form is to provide an individual or business with a Notice of Tax Due, Final Determination that the Pennsylvania Department of Revenue has made regarding a tax liability. This form is used to inform the taxpayer about the amount of tax owed, the basis for determining the tax liability, and any penalties or interest that may be applicable. The form also includes instructions on how to pay the tax or how to dispute the determination if the taxpayer disagrees with it.

What information must be reported on pa rev 1220 form?

The PA REV-1220 form, also known as the Employer's Quarterly Return for Income Taxes Withheld, is used to report information regarding the withholding of income taxes from employees' wages. The following information must be reported on this form:

1. Employer Identification Number (EIN): The unique identification number assigned to the employer by the Internal Revenue Service (IRS).

2. Employer Name and Address: The legal name and business address of the employer.

3. Reporting Period: The quarter for which the return is being filed (e.g., January to March, April to June, July to September, October to December).

4. Employee Information: Details of each employee who had income tax withheld during the reporting period, including their name, Social Security Number (SSN), and the total wages subject to income tax withholding during the quarter.

5. Income Tax Withholding: The total amount of income taxes withheld from employees' wages during the reporting period.

6. Total Quarterly Wages: The total wages subject to income tax withholding, including wages paid to all employees.

7. Total Quarterly Withholding: The sum of all income tax amounts withheld from employees' wages during the quarter.

8. Total Liability: The total amount of income tax liability for the reporting quarter, including both the employer and employee portions.

9. Payment and Deposit Information: Information regarding any tax deposit made to fulfill the income tax withholding liability for the quarter.

10. Certification: The form must be signed and certified by an authorized representative of the employer, attesting to the accuracy of the reported information.

It is important to note that this information is specific to the PA REV-1220 form for Pennsylvania state withholding taxes, and the requirements may vary for similar forms used in other states.

How can I send pa rev 1220 2008 to be eSigned by others?

To distribute your pa rev 1220 2008, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute pa rev 1220 2008 online?

pdfFiller makes it easy to finish and sign pa rev 1220 2008 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit pa rev 1220 2008 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing pa rev 1220 2008 right away.

What is PA DoR REV-1220 AS?

PA DoR REV-1220 AS is a form used by the Pennsylvania Department of Revenue to report information related to the assessment of Intangible Assets.

Who is required to file PA DoR REV-1220 AS?

Taxpayers who own intangible assets that may be subject to taxation in Pennsylvania are required to file PA DoR REV-1220 AS.

How to fill out PA DoR REV-1220 AS?

To fill out PA DoR REV-1220 AS, taxpayers should provide accurate information about their intangible assets, follow the form instructions carefully, and ensure all required fields are completed.

What is the purpose of PA DoR REV-1220 AS?

The purpose of PA DoR REV-1220 AS is to assist the Pennsylvania Department of Revenue in determining the appropriate assessment and tax obligations for intangible assets owned by taxpayers.

What information must be reported on PA DoR REV-1220 AS?

The information that must be reported on PA DoR REV-1220 AS includes details about the types of intangible assets, their values, and any relevant ownership information.

Fill out your pa rev 1220 2008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Rev 1220 2008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.