PA DoR REV-1220 AS 2008 free printable template

Show details

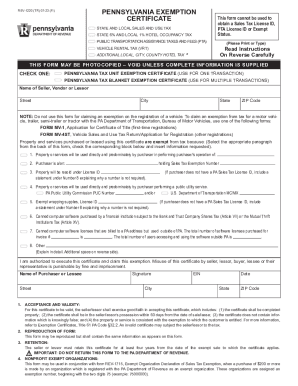

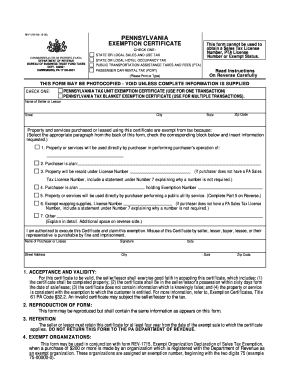

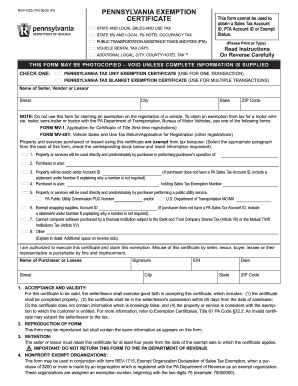

REV-1220 AS 9-08 I PENNSYLVANIA EXEMPTION CERTIFICATE CHECK ONE STATE OR LOCAL SALES AND USE TAX BUREAU OF BUSINESS TRUST FUND TAXES PO BOX 280901 HARRISBURG PA 17128-0901 This form cannot be used to obtain a Sales Tax License Number PTA License Number or Exempt Status. To claim an exemption from tax for a motor vehicle trailer semi-trailer or tractor with the PA Department of Transportation Bureau of Motor Vehicles use one of the following forms FORM MV-1 Application for Certificate of Title...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa rev 1220 2008

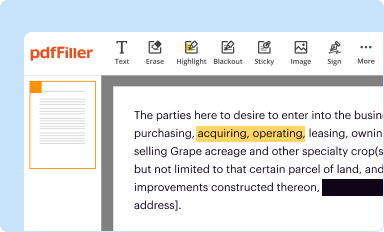

Edit your pa rev 1220 2008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

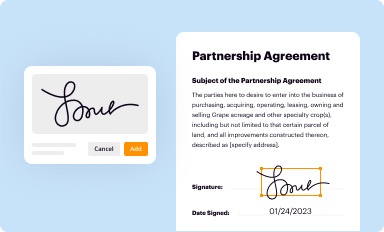

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

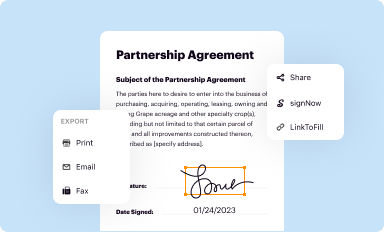

Share your form instantly

Email, fax, or share your pa rev 1220 2008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

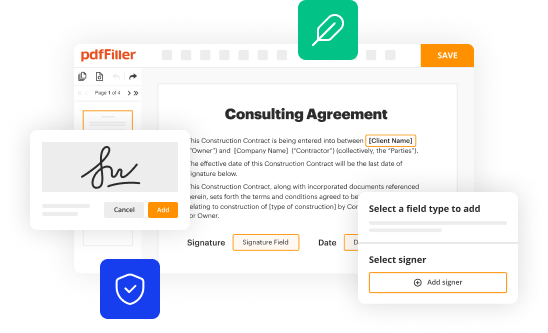

Editing pa rev 1220 2008 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pa rev 1220 2008. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-1220 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pa rev 1220 2008

How to fill out PA DoR REV-1220 AS

01

Begin by obtaining the PA DoR REV-1220 AS form from the official Pennsylvania Department of Revenue website or your local office.

02

Carefully read the instructions provided with the form for specific guidelines related to your situation.

03

Fill out the personal information section, including your name, address, and Social Security number.

04

Provide the necessary financial details as requested on the form, ensuring accuracy in numbers.

05

Include any supporting documents or additional information required as per the form instructions.

06

Review your completed form for any errors or omissions.

07

Sign and date the form, certifying the information is correct.

08

Submit the form via mail or electronically, according to the submission guidelines provided.

Who needs PA DoR REV-1220 AS?

01

Individuals or entities in Pennsylvania who need to report specific tax information to the Pennsylvania Department of Revenue.

02

Taxpayers who have taxable income or transactions that require reporting for compliance purposes.

03

Those participating in tax programs or seeking refunds related to tax credits.

Fill

form

: Try Risk Free

What is form pa rev 1220?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

People Also Ask about

How long is a Texas exemption certificate good for?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

How do I get a PA sales tax exemption certificate?

You may register for a Sales Tax License online at .pa100.state.pa.us or you can order a Combines Enterprise Registration Application from our forms ordering service by dialing toll-free, 24 hours a day, 1-800-362-2050.

Who is exemption from hotel occupancy tax in Pennsylvania?

Hotel Occupancy Tax – Guidance for U.S. Government Employees Traveling on Government Business. If an employee of the United States government is staying in a Pennsylvania hotel on official government business, the room is generally exempt from Pennsylvania hotel occupancy taxes if the room is paid for by the government

Does PA Rev 1220 expire?

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies.

How do I fill out a Pennsylvania exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What is PA Rev 1220?

1. Revised 9/8/2022. Purpose: Use this guide to properly completing the PA Exemption Certificate (REV-1220). NOTE: This. form may be used in conjunction with your sales tax/wholesaler license to claim exemptions from sales tax for the purpose of resale.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pa rev 1220 2008 to be eSigned by others?

To distribute your pa rev 1220 2008, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute pa rev 1220 2008 online?

pdfFiller makes it easy to finish and sign pa rev 1220 2008 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit pa rev 1220 2008 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing pa rev 1220 2008 right away.

What is PA DoR REV-1220 AS?

PA DoR REV-1220 AS is a form used by the Pennsylvania Department of Revenue to report information related to the assessment of Intangible Assets.

Who is required to file PA DoR REV-1220 AS?

Taxpayers who own intangible assets that may be subject to taxation in Pennsylvania are required to file PA DoR REV-1220 AS.

How to fill out PA DoR REV-1220 AS?

To fill out PA DoR REV-1220 AS, taxpayers should provide accurate information about their intangible assets, follow the form instructions carefully, and ensure all required fields are completed.

What is the purpose of PA DoR REV-1220 AS?

The purpose of PA DoR REV-1220 AS is to assist the Pennsylvania Department of Revenue in determining the appropriate assessment and tax obligations for intangible assets owned by taxpayers.

What information must be reported on PA DoR REV-1220 AS?

The information that must be reported on PA DoR REV-1220 AS includes details about the types of intangible assets, their values, and any relevant ownership information.

Fill out your pa rev 1220 2008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Rev 1220 2008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.